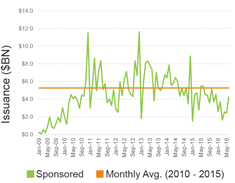

Sponsored Loan Volume Rebounds, Remains Light

The slight increase in sponsored loan volume forecasted in our last Capital Markets Outlook materialized this quarter, although the actual pick-up in activity was not commensurate with the recovery in the broader leveraged loan market(1). Middle market sponsored loan volume increased to $9.2 billion in the second quarter versus the depressed level in the first quarter of $7.9 billion. However, totaling just $17.1 billion, first half volume has declined 30% from the comparable period last year. Moreover, monthly sponsored issuance so far this year remains well below the $5.2 billion long-term average for the preceding five-year period from 2010 to 2015 (see Figure 1, right).

Middle Market Headwinds

In looking at the middle market landscape, we believe a number of factors are suppressing M&A momentum. We are hearing from private equity sponsors that auction activity has been erratic and overall deal quality has somewhat deteriorated. The challenge in deploying dry powder remains an ongoing theme as sponsors continue to lose deals to strategic acquirers and mismatched pricing expectations between buyers and sellers persist. In addition, softening economic growth has hampered the sponsor-to-sponsor trade(2). We have observed many sponsors adopting a “wait and see” mentality, preferring to invest in existing assets, with many executing on tuck-in acquisitions with an eye towards exiting when conditions improve.

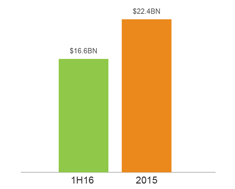

New Entrants Undeterred

Despite supply constraints, a steady stream of capital has flooded the middle market in 2016. Consider that nearly $17 billion of capital has been raised or announced so far this year—more than half the $22.4 billion tracked in all of 2015 (see Figure 2, right). As investors continue to embrace the asset class, we expect new direct lending funds to multiply as well, ensuring that conditions remain competitive. Yet, in an already competitive field, new entrants must overcome a key hurdle: scale, which we believe has allowed existing lenders to retain a first mover advantage. Scale tends to confer access to deal flow, promote selectivity and deepen sponsor relationships.

As scale becomes a key differentiator, separately managed accounts (SMAs) represent an increasingly popular vehicle for platform enhancement(3). SMAs provide lenders with an additional source of capital, which in turn can facilitate the ability to commit to larger hold sizes. As previously announced, Fifth Street closed an SMA with a large, well-respected institutional investor earlier this year. In our experience, investors find SMAs particularly appealing because they can be tailored to their specific needs relative to pooled vehicles like mutual funds, co-mingled funds or CLOs. For instance, an SMA can vary the diversity of underlying assets by hold size, tranche industry and leverage.

The Chosen Few

While new entrants proliferate, not all will survive. We believe the ongoing imbalance between supply and demand benefits top tier players with longstanding relationships at the expense of market newcomers. In today’s market, we are seeing many transactions being clubbed up between two to three sponsor-designated lenders, rather than being broadly syndicated (which allows a greater amount of smaller players to access deals). As a result, in our observation, market participants that lack an established platform tend to fall outside the consideration set.

Moreover, in today’s market, add-ons have become increasingly prevalent(2). Both add-ons and tuck-in acquisitions tend to be smaller in size compared to new buyout transactions, and they are typically handled by the incumbent lender. Competitors who lack access to an established origination portfolio as well as deep, recurrent sponsor partnerships, may very well miss this deal flow too.

Unitranche Trend Continues

Another area where we see scale as a differentiating factor is with unitranche loans, which combine senior and subordinated tranches at a blended cost. As we noted last quarter, sponsors have been gravitating towards unitranche structures, given heightened uncertainty and challenging conditions in the second lien market(4). These facilities provide sponsors with a streamlined solution that typically has a greater certainty of close.

Despite improving conditions, we note that unitranche loans continue to attract strong sponsor interest—and now, even for larger transactions. Historically, one-stop facilities have generally ranged from $100 million to $300 million in size(5). However, this quarter marked the announcement of a $1 billion unitranche facility—the largest ever on record(6).

In general, from a lender’s perspective, unitranche loans are appealing because they tend to offer higher yields. Notably, this quarter, larger transactions have become increasingly attractive relative to smaller middle market deals. In the latter, heavy competition has fueled unusually competitive pricing—an inverse of conditions we typically see, where larger deals are priced at a discount to smaller deals. Therefore, select lenders with the wherewithal to focus on unitranche transitions at the upper end of the market are likely able to achieve better risk-adjusted returns(4).

Lender Dynamics Shift

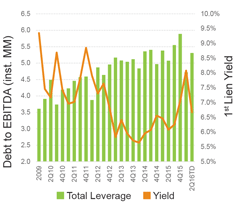

Unitranche loans aside, lenders experienced slightly less favorable dynamics this quarter. From our perspective, certain constructive signs we saw in the first quarter have somewhat receded. For instance, yields declined, although they remain above the lows of the same period last year (see Figure 3, right). In addition, 62% of middle market institutional first lien loans flexed down in 2Q16(7). On the other hand, leverage levels—which tightened in the first quarter—are now back on the rise.

With yields below 1Q16 levels, sponsors have started to take advantage of refinancing opportunities. We believe this has spurred an unfavorable bias towards dividend recapitalizations (see sidebar, right). Re-leveraging portfolio companies in order to fund sponsor dividends leaves less of a cushion for lenders, who face limited upside, but significant downside. To avoid this, we believe lenders will need heightened vigilance to identify quality deals with top tier sponsors.

Energy: Time to Test the Waters?

As we have noted throughout the dislocation, we have maintained limited energy exposure across the platform for quite some time. Given the recent stabilization in oil prices, we are now considering selectively increasing portfolio exposure. However, we maintain that lending cannot be viewed through the same lens as more liquid, tradable securities given that credit investing involves taking a view over a multi-year time horizon.

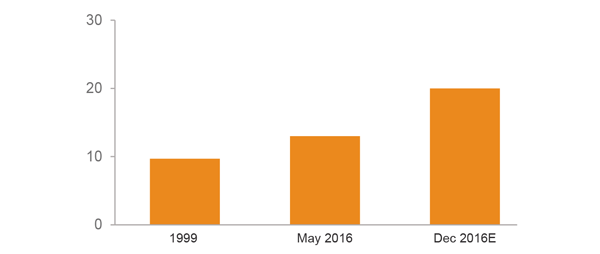

Additionally, as of May, the trailing 12-month energy high yield bond default rate stands at 13%(9). Relative to history, that compares unfavorably to 1999 when oversupply caused oil prices to dip to $19 per barrel. At that time, the default rate stood just over 9%(10). Today’s default rate already exceeds the last oil dip and Fitch is projecting that it may reach 20% by year-end(9).

Yet, despite the potential for further downward pressure, energy bonds have rallied back to levels that seem unsustainable, in our view. One bright spot we see is the approval of some key Shale projects, the economics of which appear to work at current price levels. If stability persists, we may see domestic production ramp back up. However, we question whether smaller and mid-size shale producers will gain access to much-needed credit. Until banks write down their current losses, we believe the extension of new credit will be hampered.

Trailing 12-Month Energy High Yield Bond Default Rate (%)(9)(10)

Source: Fitch Ratings and Kallanish Energy

Too Soon to Judge Brexit’s Impact

No discussion of this quarter would be complete without mentioning Brexit. While it is difficult to gauge the long-term impact, we do see a risk in underestimating the potential aftershocks.

Some have expressed concerns that Brexit will have a material ripple effect on the global economy. In the immediate aftermath, we are clearly seeing U.S. markets propelled higher as global uncertainty drives capital into the relative safety of more liquid markets. That aside, we believe there will be a delay before the consequences are fully felt in terms of a potential slowdown in M&A activity or broad reductions in UK and European financial services.

When combined with the tendency for the middle market to remain more insulated—and lag trends seen in the broader leveraged loan space—we think those potential repercussions are more likely a 2017 concern.

Fifth Street Activity

Well-Positioned for Today’s Dynamics

Fifth Street’s scale and proprietary origination platform are allowing us to find compelling opportunities amidst a slower middle market environment and broader market volatility. While others may be broad-brushing or avoiding entire industries, diligent and careful underwriting has enabled us to find attractive investments others may have overlooked.

One example is First Star Aviation, a wholly-owned portfolio company of Fifth Street Finance Corp. (FSC). First Star has a track record of purchasing and opportunistically selling planes in its portfolio and recently sold one of its planes. The sale price was higher than the original purchase price and, when factoring in the lease payments made over the life of FSC’s hold period, FSC realized a gross IRR of 19.1%.

We have also seen repeat activity owing to deep relationships with top tier sponsors. For instance, after we provided a unitranche facility in May 2015, LegalZoom—a Permira funds-owned company—returned for additional financing to support international growth. We served as both Lead Arranger & Administrative Agent for the deal, which occurred in March 2016.

Scale was a key factor placing us in the consideration set on another recent deal. We closed $110 million of senior secured credit facilities when we served as Administrative Agent, Joint Lead Arranger and Joint Bookrunner supporting the recapitalization of Ob Hospitalist Group, Inc. The company is sponsored by a fund in the Private Equity Group of Ares Management, L.P. and was tightly clubbed between Fifth Street and two other established lending platforms.

As a leading loan origination platform, we are well-positioned to win these types of first lien deals in partnership with established sponsors. We plan to continue our emphasis on quality deals higher in the capital structure given our view of where we currently stand in the credit cycle.

Robust Unitranche Pipeline

Our ability to hold larger transactions is positioning us to take advantage of attractively priced unitranche opportunities. Two-thirds of the high-priority, active deals currently in our pipeline represent unitranche facilities. The magnitude of these facilities has also trended upward, as the average deal size has grown by over 20% versus one year ago(13).

DISCLAIMER: Statements included herein about the middle market lending environment are based on observations made by Fifth Street deal professionals.

Some of the statements included herein constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, which relate to future events and/or Fifth Street Asset Management Inc.’s (“Fifth Street”) future performance or financial condition. Words such as “believes,” “expects,” “seeks,” “plans,” “should,” “estimates,” “project,” and “intend” indicate forward-looking statements. These statements are based on certain assumptions about future events or conditions and involve a number of risks and uncertainties. These statements are not guarantees of future performance, condition or results. Actual results may differ materially from those in the forward-looking statements as a result of a number of factors, including those described from time to time in our filings with the SEC.

The information contained in this article is summary information that is intended to be considered in the context of Fifth Street’s SEC filings and other public announcements that Fifth Street may make, by press release or otherwise, from time to time. Fifth Street undertakes no duty or obligation to publicly update or revise the forward-looking statements or other information contained in this article, except as required by law. These materials contain information about Fifth Street, its affiliated funds (including Fifth Street Finance Corp. and Fifth Street Senior Floating Rate Corp.) and general information about the market. You should not view information related to the past performance of Fifth Street and its affiliated funds or information about the market as indicative of future results, the achievement of which cannot be assured.

Nothing in these materials should be construed as a recommendation to invest in any securities that may be issued by Fifth Street or its affiliates or as legal, accounting or tax advice. None of Fifth Street, its affiliated funds or any affiliate of Fifth Street or its affiliated funds makes any representation or warranty, express or implied, as to the accuracy or completeness of the information contained herein and nothing contained herein shall be relied upon as a promise or representation whether as to the past or future performance. Certain information set forth herein includes estimates, projections and targets and involves significant elements of subjective judgment and analysis. No representations are made as to the accuracy of such estimates, projections or targets or that all assumptions relating to such estimates, projections or targets have been considered or stated or that such estimates, projections or targets will be realized.

This article is not intended to be an offer to sell, or the solicitation of an offer to purchase, any security (including Fifth Street Asset Management or its affiliates, Fifth Street Finance Corp. or Fifth Street Senior Floating Rate Corp.), the offer and/or sale of which can only be made by definitive offering documentation. Any other solicitation with respect to any securities that may be issued by Fifth Street or its affiliates will be made only by means of definitive offering memoranda or prospectus (as applicable), which will be provided to prospective investors and will contain material information that is not set forth herein, including risk factors relating to any such investment.