TerSera Therapeutics

Undisclosed

MARCH 2017

Pharmaceuticals

TerSera Therapeutics is a Lake Forest, IL-based pharmaceutical company that acquires and develops specialty pharmaceutical products and companies with a focus on select therapeutic areas. The company’s first platform acquisition, Zoladex, is a long-established hormonal therapy used in the treatment of prostate cancer, breast cancer and endometriosis.

Systems, Inc.

Undisclosed

MARCH 2017

Pharmaceuticals

Systems, Inc. is a Germantown, WI-based manufacturer and designer of hydraulic, pneumatic and mechanical loading dock leveling equipment, as well as truck restraints and specialty dock equipment. The company has four brands, Poweramp, DLM, McGuire and Allied Solutions, that provide products to retail, food distribution, trucking and warehouse companies worldwide.

Teaching Strategies, LLC

Undisclosed

FEBRUARY 2017

Pharmaceuticals

Teaching Strategies, LLC is a Bethesda, MD-based provider of developmentally appropriate learning solutions for early childhood education. The company offers curriculum, web-based assessment products, professional development and family resources to programs serving children from birth to grade 3.

Inteliquent, Inc.

Undisclosed

FEBRUARY 2017

Pharmaceuticals

Inteliquent is a Plymouth, MN-based communications enabler offering network-based voice and messaging services to wireless, cable, carriers, and communication service providers. Inteliquent's comprehensive suite of services include Inbound Voice, Outbound Voice, Toll Free, Neutral Tandem and Messaging services.

Dash Financial Technologies

Undisclosed

MARCH 2017

Pharmaceuticals

Dash Financial Technologies is a New York, NY-based trading technology provider to the institutional trading community. With a suite of highly customizable tools, Dash designs and delivers intelligent, high performance solutions in four product categories: Trading Technologies, Execution Services, Analytics and Regulatory Technologies.

sidebar - team

Impact Sales

$80.0 Million

DECEMBER 2016

Advertising

Impact Sales is a Boise, ID-based sales and marketing agency that provides outsourced sales, marketing and merchandising services to companies in the consumer packaged goods industry. The company offers corporate initiatives, such as promotional and sales plan display programs, as well as retail sales coverage and analytical services.

Len Tannenbaum Discusses Bond Markets, Floating Rate Loans and the Impact of Savings and Investment on U.S. Markets on "Bloomberg Daybreak: Americas"

sidebar - celebrating $10b of loans

Fifth Street's Q3 2016 Capital Markets Outlook

$ Million

OCTOBER 2016

news-media

Middling Quarter for Middle Market

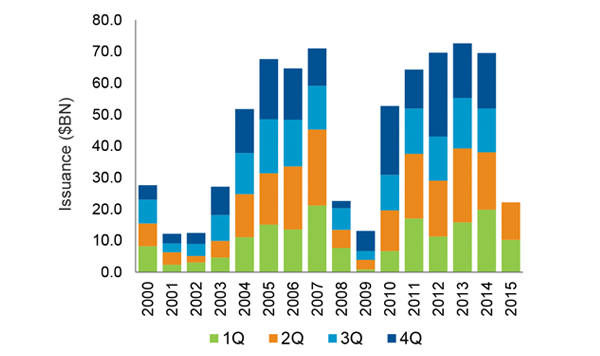

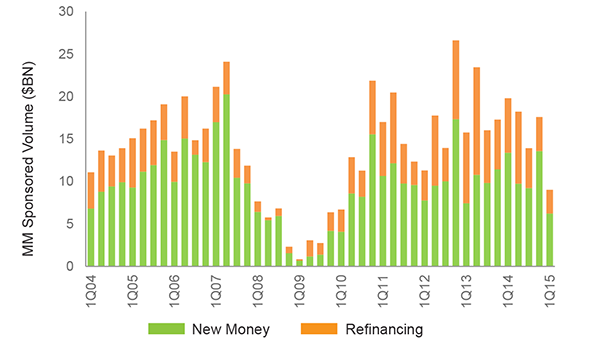

At $10.2 billion, middle market sponsored volume fell 12% from the second quarter, though it remains up from the $8.2 billion issued in the first quarter(1). From a cumulative standpoint, sponsored volume continues to fall short of 2015’s run rate: year-to-date volume stands at $30 billion, a 19% decline from the comparable period last year (see Figure 1, right). 2016 may now shape up to be the slowest for sponsored lending since 2009.

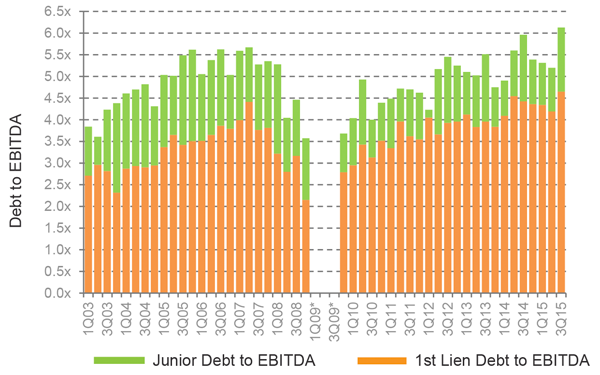

We believe a number of factors have been driving current market conditions. Geopolitical uncertainty, including the aftermath of Brexit and the upcoming presidential election, has led many investors to hit pause on new investments(2). In addition, valuation multiples remain at high levels. While updated third quarter multiples have yet to be released, results from the second quarter show how heated competition has become. For instance, the lower end of the middle market (under $25 million in enterprise value), which has seen increased interest as sponsors widen their sourcing strategies, reached a median EV/EBITDA multiple of 6.1x, approaching an all-time high (see Figure 2, below and right)(3).

Investor Interest Strains Supply

In our view, the overabundance of liquidity chasing too few deals remains an ongoing factor exacerbating the supply/demand imbalance. Yet in spite of supply constraints, there is mounting evidence that some investors may be prepared to allocate even more capital to private debt—especially direct lending. As the credit cycle continues to mature, some investors may be adopting more defensive postures: Historically, middle market loans have experienced fewer defaults and have had a higher rate of recovery compared to broadly syndicated loans(4).

Perhaps reflecting this notion, nearly 60% of the private debt investor respondents in Preqin’s H2 2016 Investor Outlook Survey expected to invest additional funds into direct lending in the next 12 months(5). That forecast comes in a year when middle market loan fundraising—which stands at $24.5 billion in capital raised to date—has already eclipsed 2015’s total of $22.4 billion(6).

Break From Tradition

Looking ahead, we expect the usual seasonal pick-up in activity and forecast a moderate increase for the fourth quarter. Yet, rather than wait for the market to solidify, some creative alternative lenders are choosing to innovate. For instance, some lenders are making a concerted outreach to non-traditional players like family offices looking for direct exposure rather than investing through a private equity sponsored vehicle(7). On the other hand, Fifth Street, in addition to supporting deals from existing sponsor relationships, is exploring other avenues, including deals in the venture space with targets that have significant enterprise value and positive EBITDA.

Borrowers Have the Upper Hand

With the supply/demand imbalance and market uncertainty lingering, we believe conditions currently favor borrowers. For instance, as competition heats up among middle market lenders, we have seen documentation requirements growing more relaxed.

While lenders generally regard “covenant-lite” as anathema in the middle market, other aggressive terms have begun to emerge. In particular, “covenant-loose” structures have surfaced that impose a leverage test, but with such wide parameters that the borrower has a greater chance of defaulting on payment before actually failing the test(8). We see these most pronounced on deals with higher yields and believe the trade-off between pricing and terms is likely to persist; however, Fifth Street is generally avoiding such structures and continues to maintain underwriting discipline when deploying capital.

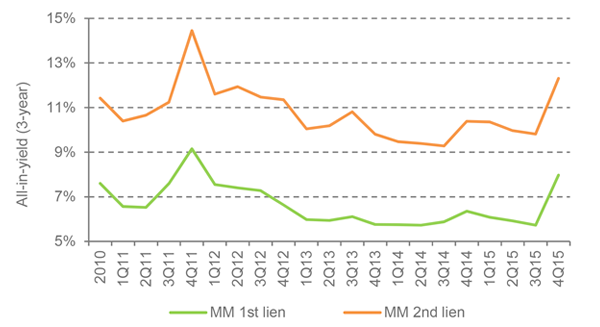

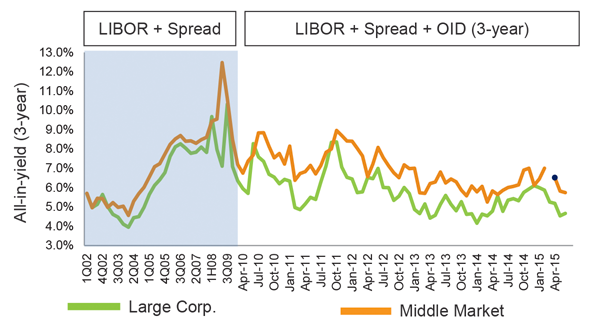

Regarding pricing, middle market average new-issue yields fell significantly last quarter to 6.09%, compared to 6.90% in Q2 and 7.10% in Q1(9). Select lenders emphasizing quality are having an even more challenging time finding attractive yields. This late in the credit cycle, we believe emphasizing first lien debt and focusing on defensive industries seems prudent; however, the spread differential between first and second lien middle market term loans stands at over 500 basis points(6). The silver lining, as we discuss later, is that borrowing conditions are favorable for alternative lenders looking to improve their capital structures, in our view.

Investors Draw the Line

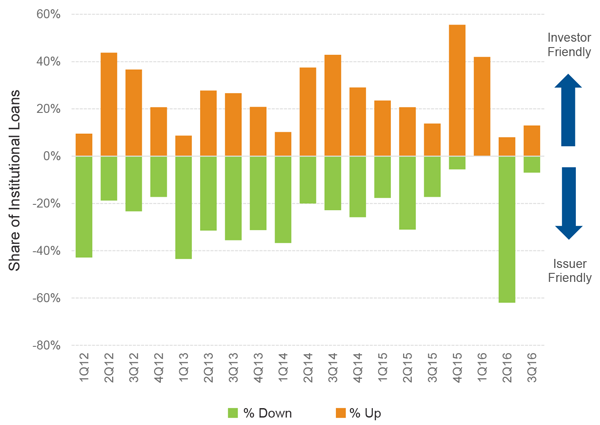

Despite the more borrower friendly environment, investors generally seem to have erred on the side of caution and some are pushing back when riskier credits are involved(10). Unlike last quarter when 62% of first lien middle market term loans flexed down, in the third quarter flex activity overall was much more subdued. Moreover, only 7% of term loans flexed down versus 13% that flexed higher (Figure 3, below)(1).

% of MM First-Lien TLs That Have Flexed(11)

Source: Thomson Reuters LPC’s Middle Market 3Q16 Review.

The Refinancing Wave

Fortunately, the surge of refinancings in the larger leveraged loan market during the third quarter did not surface to the same degree in the middle market(1). Over half of total leveraged loan issuance in the broadly-syndicated space was comprised of refinancings and repricings, as persistently low interest rates and robust investor demand allowed companies to cut costs and reduce debt through new borrowings(12). While we believe this wave is likely to continue until mergers and acquisitions and LBO activity gain momentum, the middle market has so far bucked the trend. Approximately 70% of middle market sponsored issuance can be attributed to new money volume in 2016—a pattern that continued to hold during the third quarter(1).

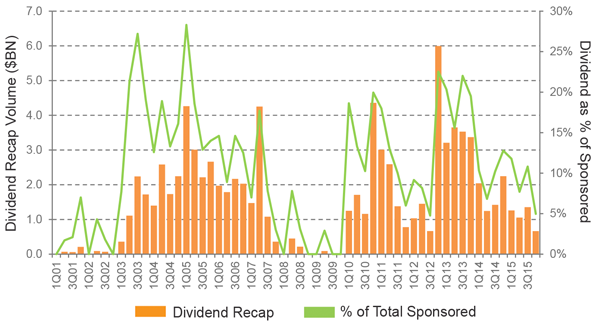

Nevertheless, we continue to adopt a selective approach when it comes to dividend recapitalizations. In many cases, we are an incumbent lender, which allows us to operate from a position of strength, choosing the ones that we believe prove mutually beneficial. To help mitigate the downside risk that re-leveraging portfolio companies may lead to, we continue to advocate for a conservative approach that emphasizes quality deals with leading sponsors.

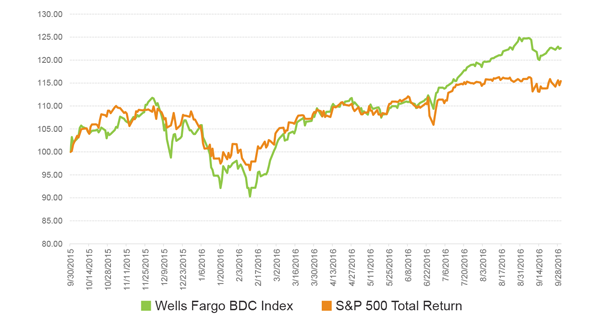

Improving Conditions for BDCs

Within the alternative lending landscape, one segment has experienced a recent rally: BDCs. The Wells Fargo Business Development Company Index has surged 20% year to date—its best performance since 2012(13).

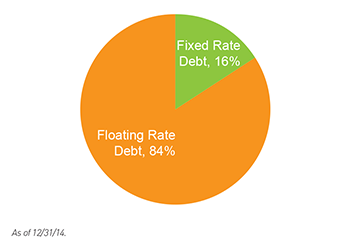

We believe benign broader equity market conditions have certainly played a role. However, other forces are also strengthening BDC valuations, in our view. Dividend reductions, investors seeking yield and stabilization in the price of oil are key contributors(14), but we also believe the prospect of floating rates is resonating more with investors. While the Federal Reserve didn’t raise rates in September, it hovers on the precipice of another rate hike likely by year end, with Bloomberg calculating the market’s expectation of a rate hike in December at 64%(15). Some investors in search of yield may be proactively positioning as the case strengthens.

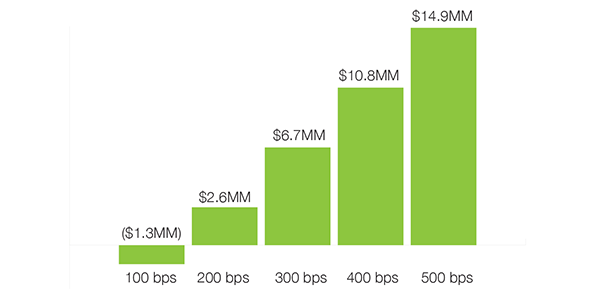

Notably, after remaining fixed for the past eight years, U.S. leveraged loans are getting closer to floating again. That is because LIBOR floors, which were initially designed to protect investors during the credit crisis and have typically been structured at 100 basis points in recent years, will dissipate when LIBOR crosses the threshold of 1%. Once LIBOR exceeds the floor, interest rates will again be tied to the benchmark, positioning lenders for higher distributions and possibly piquing investor interest even further. On October 24, 2016, the 3-month LIBOR rate was 0.88.

Wells Fargo BDC Index Total Return vs. S&P 500 Total Return

Source: FactSet and Wells Fargo Business Development Company Index.

Fifth Street Activity

Celebrating the $10 Billion Loan Landmark

As lending dynamics become more competitive, Fifth Street’s ability to source, underwrite and manage the majority of our portfolio investments continues to set us apart. Our middle market, sponsor-focused origination platform has also helped propel us to an exciting milestone: committing $10 billion of loans since inception to small and mid-sized companies.

As a leading lending partner to the private equity community, we’re proud of the longstanding relationships we have cultivated over the last 18 years. We believe our private equity sponsor clients appreciate the value-added financing solutions we provide and trust that we will deliver in a timely manner and on the promised terms.

These relationships, along with our size and scale, have enabled us to maintain a stable pipeline of attractive investment opportunities across various market environments and enabled us to selectively invest in these $10 billion of loans. More importantly, our sponsor-focused origination platform continues to be a key driver of value for our shareholders today.

Spotlight on YETI

One particularly memorable deal tangibly demonstrates the power of our platform. Based in Austin, Texas, YETI is a designer and marketer of premium coolers. When we provided a one-stop financing facility of $47.5 million back in 2012, we recognized YETI’s potential. The transaction, which was funded by Fifth Street Finance Corp. and included co-investment rights, provided us an equity stake in YETI, which is still outstanding as of June 30, 2016.

While it was our first deal with YETI’s sponsor, Cortec Group, they were attracted to our deep understanding of the company’s objectives. They were also impressed with our ability to rapidly evaluate and execute on a compelling opportunity in a tight time frame. At the time, we noted that YETI’s universal value proposition with high quality products was in the infancy of its life cycle and today, we continue to look forward to seeing what their next stage of growth has in store.

DISCLAIMER: Statements included herein about the middle market lending environment are based on observations made by Fifth Street deal professionals.

Some of the statements included herein constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, which relate to future events and/or Fifth Street Asset Management Inc.’s (“Fifth Street”) future performance or financial condition. Words such as “believes,” “expects,” “seeks,” “plans,” “should,” “estimates,” “project,” and “intend” indicate forward-looking statements. These statements are based on certain assumptions about future events or conditions and involve a number of risks and uncertainties. These statements are not guarantees of future performance, condition or results. Actual results may differ materially from those in the forward-looking statements as a result of a number of factors, including those described from time to time in our filings with the SEC.

The information contained in this article is summary information that is intended to be considered in the context of Fifth Street’s SEC filings and other public announcements that Fifth Street may make, by press release or otherwise, from time to time. Fifth Street undertakes no duty or obligation to publicly update or revise the forward-looking statements or other information contained in this article, except as required by law. These materials contain information about Fifth Street, its affiliated funds (including Fifth Street Finance Corp. and Fifth Street Senior Floating Rate Corp.) and general information about the market. You should not view information related to the past performance of Fifth Street and its affiliated funds or information about the market as indicative of future results, the achievement of which cannot be assured.

Nothing in these materials should be construed as a recommendation to invest in any securities that may be issued by Fifth Street or its affiliates or as legal, accounting or tax advice. None of Fifth Street, its affiliated funds or any affiliate of Fifth Street or its affiliated funds makes any representation or warranty, express or implied, as to the accuracy or completeness of the information contained herein and nothing contained herein shall be relied upon as a promise or representation whether as to the past or future performance. Certain information set forth herein includes estimates, projections and targets and involves significant elements of subjective judgment and analysis. No representations are made as to the accuracy of such estimates, projections or targets or that all assumptions relating to such estimates, projections or targets have been considered or stated or that such estimates, projections or targets will be realized.

This article is not intended to be an offer to sell, or the solicitation of an offer to purchase, any security (including Fifth Street Asset Management or its affiliates, Fifth Street Finance Corp. or Fifth Street Senior Floating Rate Corp., the offer and/or sale of which can only be made by definitive offering documentation. Any other solicitation with respect to any securities that may be issued by Fifth Street or its affiliates will be made only by means of definitive offering memoranda or prospectus (as applicable), which will be provided to prospective investors and will contain material information that is not set forth herein, including risk factors relating to any such investment.

Hoffman Southwest Corporation

$84.7 Million

AUGUST 2016

Environmental & Facilities Services

Hoffman Southwest Corporation is a Mission Viejo, CA-based provider of comprehensive water flow solutions services. The company has three complementary divisions: HSW Roto-Rooter, ProPipe and Western Drain, all of which help maintain healthy underground infrastructures in the Western United States.

sidebar - a word about risk (individual - relative)

Fifth Street's Q2 2016 Capital Markets Outlook

$ Million

JULY 2016

news-media

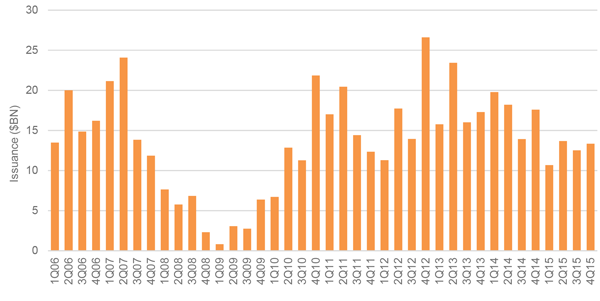

Sponsored Loan Volume Rebounds, Remains Light

The slight increase in sponsored loan volume forecasted in our last Capital Markets Outlook materialized this quarter, although the actual pick-up in activity was not commensurate with the recovery in the broader leveraged loan market(1). Middle market sponsored loan volume increased to $9.2 billion in the second quarter versus the depressed level in the first quarter of $7.9 billion. However, totaling just $17.1 billion, first half volume has declined 30% from the comparable period last year. Moreover, monthly sponsored issuance so far this year remains well below the $5.2 billion long-term average for the preceding five-year period from 2010 to 2015 (see Figure 1, right).

Middle Market Headwinds

In looking at the middle market landscape, we believe a number of factors are suppressing M&A momentum. We are hearing from private equity sponsors that auction activity has been erratic and overall deal quality has somewhat deteriorated. The challenge in deploying dry powder remains an ongoing theme as sponsors continue to lose deals to strategic acquirers and mismatched pricing expectations between buyers and sellers persist. In addition, softening economic growth has hampered the sponsor-to-sponsor trade(2). We have observed many sponsors adopting a “wait and see” mentality, preferring to invest in existing assets, with many executing on tuck-in acquisitions with an eye towards exiting when conditions improve.

New Entrants Undeterred

Despite supply constraints, a steady stream of capital has flooded the middle market in 2016. Consider that nearly $17 billion of capital has been raised or announced so far this year—more than half the $22.4 billion tracked in all of 2015 (see Figure 2, right). As investors continue to embrace the asset class, we expect new direct lending funds to multiply as well, ensuring that conditions remain competitive. Yet, in an already competitive field, new entrants must overcome a key hurdle: scale, which we believe has allowed existing lenders to retain a first mover advantage. Scale tends to confer access to deal flow, promote selectivity and deepen sponsor relationships.

As scale becomes a key differentiator, separately managed accounts (SMAs) represent an increasingly popular vehicle for platform enhancement(3). SMAs provide lenders with an additional source of capital, which in turn can facilitate the ability to commit to larger hold sizes. As previously announced, Fifth Street closed an SMA with a large, well-respected institutional investor earlier this year. In our experience, investors find SMAs particularly appealing because they can be tailored to their specific needs relative to pooled vehicles like mutual funds, co-mingled funds or CLOs. For instance, an SMA can vary the diversity of underlying assets by hold size, tranche industry and leverage.

The Chosen Few

While new entrants proliferate, not all will survive. We believe the ongoing imbalance between supply and demand benefits top tier players with longstanding relationships at the expense of market newcomers. In today’s market, we are seeing many transactions being clubbed up between two to three sponsor-designated lenders, rather than being broadly syndicated (which allows a greater amount of smaller players to access deals). As a result, in our observation, market participants that lack an established platform tend to fall outside the consideration set.

Moreover, in today’s market, add-ons have become increasingly prevalent(2). Both add-ons and tuck-in acquisitions tend to be smaller in size compared to new buyout transactions, and they are typically handled by the incumbent lender. Competitors who lack access to an established origination portfolio as well as deep, recurrent sponsor partnerships, may very well miss this deal flow too.

Unitranche Trend Continues

Another area where we see scale as a differentiating factor is with unitranche loans, which combine senior and subordinated tranches at a blended cost. As we noted last quarter, sponsors have been gravitating towards unitranche structures, given heightened uncertainty and challenging conditions in the second lien market(4). These facilities provide sponsors with a streamlined solution that typically has a greater certainty of close.

Despite improving conditions, we note that unitranche loans continue to attract strong sponsor interest—and now, even for larger transactions. Historically, one-stop facilities have generally ranged from $100 million to $300 million in size(5). However, this quarter marked the announcement of a $1 billion unitranche facility—the largest ever on record(6).

In general, from a lender’s perspective, unitranche loans are appealing because they tend to offer higher yields. Notably, this quarter, larger transactions have become increasingly attractive relative to smaller middle market deals. In the latter, heavy competition has fueled unusually competitive pricing—an inverse of conditions we typically see, where larger deals are priced at a discount to smaller deals. Therefore, select lenders with the wherewithal to focus on unitranche transitions at the upper end of the market are likely able to achieve better risk-adjusted returns(4).

Lender Dynamics Shift

Unitranche loans aside, lenders experienced slightly less favorable dynamics this quarter. From our perspective, certain constructive signs we saw in the first quarter have somewhat receded. For instance, yields declined, although they remain above the lows of the same period last year (see Figure 3, right). In addition, 62% of middle market institutional first lien loans flexed down in 2Q16(7). On the other hand, leverage levels—which tightened in the first quarter—are now back on the rise.

With yields below 1Q16 levels, sponsors have started to take advantage of refinancing opportunities. We believe this has spurred an unfavorable bias towards dividend recapitalizations (see sidebar, right). Re-leveraging portfolio companies in order to fund sponsor dividends leaves less of a cushion for lenders, who face limited upside, but significant downside. To avoid this, we believe lenders will need heightened vigilance to identify quality deals with top tier sponsors.

Energy: Time to Test the Waters?

As we have noted throughout the dislocation, we have maintained limited energy exposure across the platform for quite some time. Given the recent stabilization in oil prices, we are now considering selectively increasing portfolio exposure. However, we maintain that lending cannot be viewed through the same lens as more liquid, tradable securities given that credit investing involves taking a view over a multi-year time horizon.

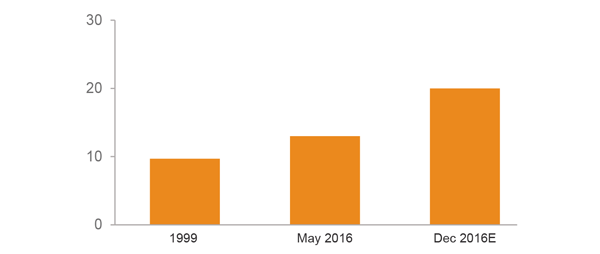

Additionally, as of May, the trailing 12-month energy high yield bond default rate stands at 13%(9). Relative to history, that compares unfavorably to 1999 when oversupply caused oil prices to dip to $19 per barrel. At that time, the default rate stood just over 9%(10). Today’s default rate already exceeds the last oil dip and Fitch is projecting that it may reach 20% by year-end(9).

Yet, despite the potential for further downward pressure, energy bonds have rallied back to levels that seem unsustainable, in our view. One bright spot we see is the approval of some key Shale projects, the economics of which appear to work at current price levels. If stability persists, we may see domestic production ramp back up. However, we question whether smaller and mid-size shale producers will gain access to much-needed credit. Until banks write down their current losses, we believe the extension of new credit will be hampered.

Trailing 12-Month Energy High Yield Bond Default Rate (%)(9)(10)

Source: Fitch Ratings and Kallanish Energy

Too Soon to Judge Brexit’s Impact

No discussion of this quarter would be complete without mentioning Brexit. While it is difficult to gauge the long-term impact, we do see a risk in underestimating the potential aftershocks.

Some have expressed concerns that Brexit will have a material ripple effect on the global economy. In the immediate aftermath, we are clearly seeing U.S. markets propelled higher as global uncertainty drives capital into the relative safety of more liquid markets. That aside, we believe there will be a delay before the consequences are fully felt in terms of a potential slowdown in M&A activity or broad reductions in UK and European financial services.

When combined with the tendency for the middle market to remain more insulated—and lag trends seen in the broader leveraged loan space—we think those potential repercussions are more likely a 2017 concern.

Fifth Street Activity

Well-Positioned for Today’s Dynamics

Fifth Street’s scale and proprietary origination platform are allowing us to find compelling opportunities amidst a slower middle market environment and broader market volatility. While others may be broad-brushing or avoiding entire industries, diligent and careful underwriting has enabled us to find attractive investments others may have overlooked.

One example is First Star Aviation, a wholly-owned portfolio company of Fifth Street Finance Corp. (FSC). First Star has a track record of purchasing and opportunistically selling planes in its portfolio and recently sold one of its planes. The sale price was higher than the original purchase price and, when factoring in the lease payments made over the life of FSC’s hold period, FSC realized a gross IRR of 19.1%.

We have also seen repeat activity owing to deep relationships with top tier sponsors. For instance, after we provided a unitranche facility in May 2015, LegalZoom—a Permira funds-owned company—returned for additional financing to support international growth. We served as both Lead Arranger & Administrative Agent for the deal, which occurred in March 2016.

Scale was a key factor placing us in the consideration set on another recent deal. We closed $110 million of senior secured credit facilities when we served as Administrative Agent, Joint Lead Arranger and Joint Bookrunner supporting the recapitalization of Ob Hospitalist Group, Inc. The company is sponsored by a fund in the Private Equity Group of Ares Management, L.P. and was tightly clubbed between Fifth Street and two other established lending platforms.

As a leading loan origination platform, we are well-positioned to win these types of first lien deals in partnership with established sponsors. We plan to continue our emphasis on quality deals higher in the capital structure given our view of where we currently stand in the credit cycle.

Robust Unitranche Pipeline

Our ability to hold larger transactions is positioning us to take advantage of attractively priced unitranche opportunities. Two-thirds of the high-priority, active deals currently in our pipeline represent unitranche facilities. The magnitude of these facilities has also trended upward, as the average deal size has grown by over 20% versus one year ago(13).

DISCLAIMER: Statements included herein about the middle market lending environment are based on observations made by Fifth Street deal professionals.

Some of the statements included herein constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, which relate to future events and/or Fifth Street Asset Management Inc.’s (“Fifth Street”) future performance or financial condition. Words such as “believes,” “expects,” “seeks,” “plans,” “should,” “estimates,” “project,” and “intend” indicate forward-looking statements. These statements are based on certain assumptions about future events or conditions and involve a number of risks and uncertainties. These statements are not guarantees of future performance, condition or results. Actual results may differ materially from those in the forward-looking statements as a result of a number of factors, including those described from time to time in our filings with the SEC.

The information contained in this article is summary information that is intended to be considered in the context of Fifth Street’s SEC filings and other public announcements that Fifth Street may make, by press release or otherwise, from time to time. Fifth Street undertakes no duty or obligation to publicly update or revise the forward-looking statements or other information contained in this article, except as required by law. These materials contain information about Fifth Street, its affiliated funds (including Fifth Street Finance Corp. and Fifth Street Senior Floating Rate Corp.) and general information about the market. You should not view information related to the past performance of Fifth Street and its affiliated funds or information about the market as indicative of future results, the achievement of which cannot be assured.

Nothing in these materials should be construed as a recommendation to invest in any securities that may be issued by Fifth Street or its affiliates or as legal, accounting or tax advice. None of Fifth Street, its affiliated funds or any affiliate of Fifth Street or its affiliated funds makes any representation or warranty, express or implied, as to the accuracy or completeness of the information contained herein and nothing contained herein shall be relied upon as a promise or representation whether as to the past or future performance. Certain information set forth herein includes estimates, projections and targets and involves significant elements of subjective judgment and analysis. No representations are made as to the accuracy of such estimates, projections or targets or that all assumptions relating to such estimates, projections or targets have been considered or stated or that such estimates, projections or targets will be realized.

This article is not intended to be an offer to sell, or the solicitation of an offer to purchase, any security (including Fifth Street Asset Management or its affiliates, Fifth Street Finance Corp. or Fifth Street Senior Floating Rate Corp.), the offer and/or sale of which can only be made by definitive offering documentation. Any other solicitation with respect to any securities that may be issued by Fifth Street or its affiliates will be made only by means of definitive offering memoranda or prospectus (as applicable), which will be provided to prospective investors and will contain material information that is not set forth herein, including risk factors relating to any such investment.

ANCILE Solutions

$160.0 Million

JUNE 2016

Internet Software & Services

ANCILE is an Elkridge, MD-based software provider that facilitates employee training and education on over 100 business applications, including SAP, Salesforce, Oracle, IBM and others. The company’s solutions help organizations recognize the full potential of the technology they use by increasing employee understanding, proficiency and adoption.

Ping Identity

Undisclosed

AUGUST 2016

Internet Software & Services

Ping Identity is a Denver, CO-based provider of identity and access management software. The company’s next generation solutions enable enterprises around the world to manage access to applications and increase security across their IT systems.

Ob Hospitalist Group

$110.0 Million

JUNE 2016

Healthcare Services

OB Hospitalist Group is a Mauldin, SC-based developer and manager of 24/7, on-site OB/GYN hospitalist programs. The company collaborates with partner hospitals, physicians and staff to create customized solutions that align with each patient’s objectives and expectations. Ob Hospitalist Group ensures each partner hospital is staffed with a strong Board Certified, OB/GYN physician team, and provides comprehensive and financially viable programs that raise the quality of care for women, newborns and families.

Onvoy

Undisclosed

APRIL 2016

Integrated Telecommunication Services

Onvoy is a Minneapolis, MN-based provider of wholesale voice-enabling services across the U.S. Through its intuitive software-based Application Program Interface and nationwide carrier-grade network, the company helps clients build, provision and support more innovative and integrated communication services through easy-to-use voice, messaging and mobility solutions.

Fifth Street's Q1 2016 Capital Markets Outlook

$ Million

APRIL 2016

news-media

Volume Declines Dramatically

Totaling just $7.33 billion, sponsored middle market loan volume reached a six-year low in the first quarter—exceptionally weak even when viewed against the traditional seasonal pattern of lighter volume. On the heels of a sluggish year in 2015, we remained cautious in our outlook for the new year; yet, volume dropped more precipitously than expected. Sponsored issuance was down 45% from the fourth quarter of 2015 and 31% on a year-over-year basis (see Figure 1, right).

The Story Behind the Slump

A number of factors contributed to the Q1 slowdown. U.S. private equity investment is clearly experiencing a lull. Although add-on acquisitions remained comparatively stable in the first quarter, LBO volume dropped 55% quarter over quarter and 49% year over year (See Figure 2, right and below).

The decline in transaction activity can be partly attributed to mismatched expectations between buyers and sellers. From a buyer’s perspective, few could justify paying for valuations based on peak EBITDA in a slowing economy—especially when faced with more expensive financing due to rising yields. On the other hand, heavy competition from strategic acquirers helped reinforce the belief among high quality sellers that they still held the upper hand.

All of this unfolded against the backdrop of a weakening macroeconomic picture. Fluctuating oil prices and credit woes in energy and commodities, combined with concerns of spillover effects from slowing global growth, rattled investors who were already uneasy heading into 2016. Factor in a particularly unpredictable election year and ongoing debate over central bank policy response, and confidence has faltered even more.

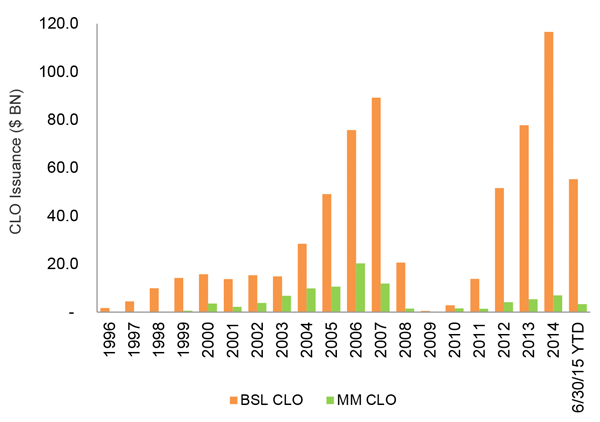

Demand Takes a Breather

Also playing a role are investor challenges, which range from a lack of liquidity in the CLO and BDC markets to a general slowdown in fundraising among private debt vehicles. For instance, private debt capital formation totaled just $3.9 billion in the first quarter—a lackluster pace that failed to match the rapid expansion of $91 billion seen for all of last year(1).

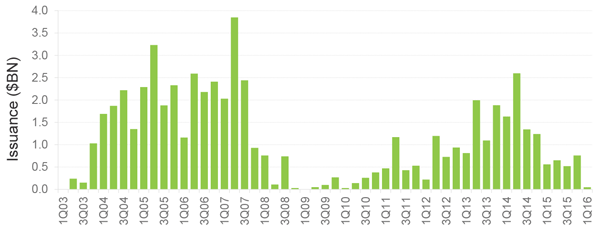

Likewise, anemic CLO issuance undermined demand, although it did gather momentum as the quarter unfolded. Cumulative Q1 2016 issuance stood at $8.2 billion, a pronounced decline from $29.8 billion for the same period last year(2).

Meanwhile, most of the BDC universe traded below book value, making it very difficult to grow via follow-on equity offerings. Finally, energy exposure at traditional banks stood in the regulatory cross-hairs, creating a risk-off mentality which diminished the appetite for credit (see sidebar). In short, the cumulative impact on deal flow poses challenges; however, we believe it has also created opportunities for discerning lenders.

Proceed with Caution

or Green Shoots Ahead?

As the quarter drew to a close, the overall leveraged loan market appeared to regain some stability, aided by renewed confidence in U.S. economic expansion, a strong rally in global equities and a rush of inflows into the high yield bond market.

We believe this general improvement in sentiment bodes well for the middle market, which tends to follow suit. Based on our pipeline activity, we remain hopeful for a brisker pace of private equity M&A activity in the quarters ahead. However, our expectations for a material increase from today’s depressed levels are tempered by our outlook for lackluster volume for the year as a whole.

Amid Weakness,

Lenders See Silver Lining

Fear of a deteriorating credit environment has definitely put investors on edge, contributing to another uptick in yields this quarter. U.S. middle market term loan yields widened to 7.3% from 7.1% one quarter ago and 6.7% for the same period last year(3). Middle market lenders note that they are finally receiving adequate compensation for risk, while also acknowledging they are beginning to see some cracks in their portfolios.

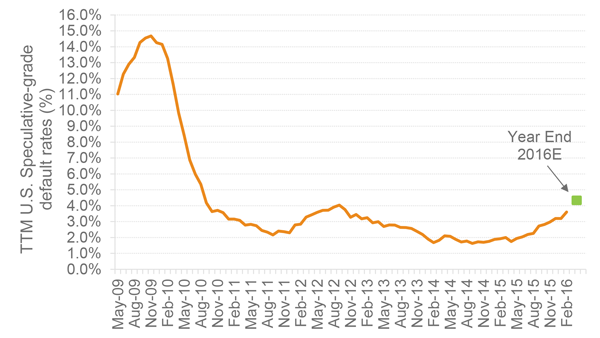

Though few would characterize it as a default wave, there has been a noticeable stall in earnings, earnings growth and revenues. By the end of 2016, Moody’s projects the loan only default rate will climb to 4.2%. While the middle market typically lags the broader market in this respect, one might view the trend as a harbinger of things to come (see Figure 3, below).

From a sector standpoint, we continue to emphasize healthcare and technology relative to cyclical sectors, thanks to favorable macro trends and the ability to draw on proprietary insights to help unlock potential value.

We have also noticed that prudent lenders have begun to adjust terms in response to market conditions and the potential for an economic pullback in the next few years. In some instances, lenders are able to dictate and achieve more conservative terms. Tighter covenant packages and fewer “large market terms” were among the noticeable trends during the quarter.

Moody’s Speculative Grade Default Rate

Source: Thomson Reuters LPC’s 2Q16 MM Investor Outlook Survey.

Sponsors Gravitate to Unitranche

A subdued environment and ongoing credit woes are also having an impact on structure. Prudent middle market lenders like Fifth Street are continuing to adopt defensive positions, moving up the capital stack into first lien, higher priority assets.

From a sponsor standpoint, the unitranche structure seems to have become even more popular. The surge can likely be traced to heightened uncertainty combined with an uptick in senior pricing and a fall-off in second lien volume. With a risk-off mode prevailing for much of the quarter, second lien issuance was anemic, totaling only $47.5 million—a level not seen since Q1 2010 (see Figure 5, below).

In some instances, the unitranche structure is favored by sponsors who want to circumvent the auction process entirely. In these cases, sponsors are approaching lenders to get a deal done expeditiously without attracting the kind of attention that could prompt a bidding war. Heightened uncertainty has also inured to the benefit of lenders with deep private equity relationships and the wherewithal to hold larger positions. These select lenders are gaining ground as sponsors are increasingly shifting away from “underwrite to syndicate” solutions and toward “buy and hold” solutions with their most trusted debt providers. This helps explain the increasing number of “pari passu” unitranches, and the decrease in first out/last out structures.

Middle Market Second Lien Issuance

Source: Thomson Reuters LPC (4/8/16).

Too Early For Energy

With oil prices strengthening over the quarter, we see some lenders considering increasing their portfolio exposure. In fact, oil and gas loan bids regained a small piece of lost territory, closing the quarter just below 60, up 5 points from February’s low point(2). However, as we noted last quarter, we continue to believe that energy has further downside potential and has not yet reached a bottom.

While rig count has declined in the U.S., we believe oil producers like Saudi Arabia and Iran have yet to reconcile their disparate views on supply. For instance, Iran has not yet agreed to take part in the current freeze under discussion. In our view, the oil issue has devolved into a case of each side waiting for the other to blink first.

With oversupply being a key driver behind today’s depressed oil price levels, it’s difficult for us to foresee stabilization until these two major players set aside their regional rivalry and agree to work together to reassert a balance. That said, an additional 1.2 million barrels of demand is expected to come on this year. When coupled with a potential reduction of 800,000 barrels of supply in the U.S., output may stabilize this fall.

Fifth Street Activity

The Table is Set for Good Vintage

Due to broader market volatility and uncertainty, we have noticed a widening of spreads in the middle market, creating opportunities for strong risk-adjusted returns. As a result, we have been able to find attractive pricing at the higher end of the capital structure for select deals and look forward to continuing to invest in this more lender friendly environment.

As previously mentioned, we believe that lenders with flexible, long term capital will look back favorably on the vintages of 2016 and 2017 similarly to those of 2009 and 2010.

Relationships Mean More Than Ever

Despite a slower quarter, Fifth Street remains well positioned on several fronts. In times of uncertainty, relationships come to the fore. We are proud to be one of the premier lending partners to sponsors in the middle market due to the quality and breadth of our platform, relationships and people.

Fifth Street is also widely recognized for our unitranche specialty, with the ability to hold loans up to $250 million on our balance sheet. In these times, our top sponsors have been relying on us even more to delve deeply into each transaction and find creative ways to ensure their timely and effective completion.

For sponsors, experience also counts. Lenders like Fifth Street—who have successfully navigated past economic cycles and demonstrated a steadfast willingness to support sponsors and their portfolio companies through growth phases as well as setbacks— top their shortlist.

As always, our main priority remains supporting our sponsors and deepening those relationships by showing both flexibility and strength.

DISCLAIMER: Statements included herein about the middle market lending environment are based on observations made by Fifth Street deal professionals and were corroborated by Thomson Reuters LPC survey data and Preqin.

Some of the statements included herein constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, which relate to future events and/or Fifth Street Asset Management Inc.’s (“Fifth Street”) future performance or financial condition. Words such as “believes,” “expects,” “seeks,” “plans,” “should,” “estimates,” “project,” and “intend” indicate forward-looking statements. These statements are based on certain assumptions about future events or conditions and involve a number of risks and uncertainties. These statements are not guarantees of future performance, condition or results. Actual results may differ materially from those in the forward-looking statements as a result of a number of factors, including those described from time to time in our filings with the SEC.

The information contained in this article is summary information that is intended to be considered in the context of Fifth Street’s SEC filings and other public announcements that Fifth Street may make, by press release or otherwise, from time to time. Fifth Street undertakes no duty or obligation to publicly update or revise the forward-looking statements or other information contained in this article, except as required by law. These materials contain information about Fifth Street, its affiliated funds (including Fifth Street Finance Corp. and Fifth Street Senior Floating Rate Corp.) and general information about the market. You should not view information related to the past performance of Fifth Street and its affiliated funds or information about the market as indicative of future results, the achievement of which cannot be assured.

Nothing in these materials should be construed as a recommendation to invest in any securities that may be issued by Fifth Street or its affiliates or as legal, accounting or tax advice. None of Fifth Street, its affiliated funds or any affiliate of Fifth Street or its affiliated funds makes any representation or warranty, express or implied, as to the accuracy or completeness of the information contained herein and nothing contained herein shall be relied upon as a promise or representation whether as to the past or future performance. Certain information set forth herein includes estimates, projections and targets and involves significant elements of subjective judgment and analysis. No representations are made as to the accuracy of such estimates, projections or targets or that all assumptions relating to such estimates, projections or targets have been considered or stated or that such estimates, projections or targets will be realized.

This article is not intended to be an offer to sell, or the solicitation of an offer to purchase, any security (including Fifth Street Asset Management or its affiliates, Fifth Street Finance Corp. or Fifth Street Senior Floating Rate Corp.), the offer and/or sale of which can only be made by definitive offering documentation. Any other solicitation with respect to any securities that may be issued by Fifth Street or its affiliates will be made only by means of definitive offering memoranda or prospectus (as applicable), which will be provided to prospective investors and will contain material information that is not set forth herein, including risk factors relating to any such investment.

Lytx

Undisclosed

AUGUST 2016

Research & Consulting Services

Lytx, Inc. is a San Diego, CA-based provider of video-based safety solutions for commercial and public sector transportation fleets. The company’s solutions work to reduce accidents and improve driver behavior while helping clients realize lower operating and insurance costs.

Ansira

$43.0 Million

OCTOBER 2015

Advertising

Ansira is a St. Louis, MO-based marketing firm that focuses on both client channel partners and direct marketing to consumers. Ansira uses their customer engagement marketing services to assist many Fortune 1000 brands.

Argon Medical Devices

$125.0+ Million

DECEMBER 2015

Healthcare Equipment

Argon is a Plano, TX-based global manufacturer and supplier of single-use specialty medical devices used for interventional radiology and cardiology, vascular surgery and critical care procedures.

NAVEX Global, Inc.

$131.0 Million

OCTOBER 2015

Internet Software & Services

NAVEX Global Inc. is a Lake Oswego, OR-based ethics and compliance software provider that helps organizations contain risks, maintain an ethical culture and stay compliant to regulations, such as Sarbanes-Oxley, Dodd-Frank, the UK Bribery Act and numerous others.

Fifth Street's Q4 2015 Capital Markets Outlook

$ Million

JANUARY 2016

news-media

No Late Rescue

for Loan Volume

In 2015, sponsored middle market loan volume reached $50.3 billion, down 28% from 2014, falling below expectations and capping the weakest year for volume since 2009 (See Figure 1, below). Issuance dropped every quarter year-over-year, and 4Q15 was no exception. Despite volume rising 7% from the third quarter, at $13.4 billion, fourth quarter volume was still down nearly 25% from the prior year period.

For many lenders, including Fifth Street, the typical seasonal push that occurs at calendar year end was muted in 2015(1). A number of factors contributed to the protracted slowdown in sponsored deals, including an increase in borrowing costs and buyer/seller divergence stemming from lower deal quality and lofty valuations, as strategic buyers continued to drive up multiples. Combined, these factors have created a more challenging environment for sponsors, many of whom we believe have chosen to wait on the sidelines in hopes of better returns.

Quarterly Sponsored Issuance

Source: Thomson Reuters LPC’s Middle Market 4Q15 Review (1/8/16).

Vintage Years on Tap

While many lenders expect volumes to be flat in 2016(2), we hold a more hopeful view for middle market sponsored lending. With backlog down from recent years, we are not expecting a rebound in the first quarter, but believe things should pick up later in 2016, as the market gradually adjusts to the new reality of higher borrowing costs.

Private equity firms have raised considerable capital and have record amounts of dry powder at their disposal. The level of unspent capital reached a record of $752 billion by the end of 2015, up from $695 billion the prior year, which will need to be put to work at some point (See Figure 2, right).

We believe that years from now, lenders with capital to invest in new loans will look back on the vintages of 2016 and 2017 as similar to the favorable vintages of 2009 and 2010. With spreads widening, it seems that prudent lenders will start getting adequately paid for risk. Given crashing oil prices and the disarray in high-yield, we think the table is set—as it was in the aftermath of the financial crisis of 2008—for lenders to deploy capital into deals with strong risk-adjusted returns. It could be an exciting opportunity for lenders with long-term capital and the flexibility to selectively deploy it. However, absent discerning underwriting, capital is not enough. Instead, a high level of selectivity driven by superior sourcing represents the key to success in our view.

Yields Widen, Hurting

Dividend Recapitalizations

For the first time in a few years, yields are significantly higher in the middle market. Assuming a three-year duration, the average yield for a middle market first-lien term loan is at the highest level since 2012, climbing to 7.14% for the quarter, up from 6.25% in 3Q15 and 5.96% in 2Q15(3). Notably, higher yields have created significant headwinds for dividend recapitalizations, which had volume of just $4.3 billion for all of 2015, representing a 38% decline from 2014 and the lowest level in six years (See Figure 3, below).

Middle Market Dividend Recap Volume

Source: Thomson Reuters LPC’s Middle Market 4Q15 Review (1/8/16).

Flight to Quality

Impacts Second Lien

Amidst weaker volume, there still appears to be ample capacity in the middle market. However, lenders continue to gravitate to certain credits over others, with many focused on plain vanilla companies with no noise and minimal adjustments. Additionally, in a noticeable flight to quality, many lenders continue to migrate to senior, floating rate securities(1). This is not unexpected, as periods of volatility tend to create a risk-off response and a move up the capital structure.

To that end, middle market second lien volume reached just $2.5 billion for the year—a 64% decline from 2014(3). The diminished appetite for second lien volume can also be traced to a weakened buyer base: many BDCs are currently trading below book value, while hedge funds have had to reassess and redeploy their own assets in the wake of a tumultuous 2015. The heightened uncertainty has unsettled sponsors, many of whom are proceeding straight to the unitranche product given the certainty of close, versus a first and second lien structure(4).

Given the sharp drop-off in second lien bids, yields on middle market second-liens moved drastically wider this quarter. The average yield has risen to 12.31%, up 249bps from 9.82% in 3Q15 (See Figure 5, below). The resulting supply/demand imbalance leads us to believe that selective opportunities for strong-risk adjusted returns in second lien may lie ahead.

First and Second Lien Yields: Middle Market and Large Corp.

Source: Thomson Reuters LPC’s 2015 Review / 2016 Preview (1/13/16).

Note: Only includes yield data from deals with first lien / second lien structures.

Markets Shrug Off the Fed

The Fed’s recent interest-rate hike was both widely anticipated and priced-in by market participants and, in our view, has had a de minimis impact on the middle market.

Amid weak economic indicators, we expect the Fed to proceed slowly and cautiously with future increases. Since uncertainty remains in the markets, we believe policymakers will try to avoid adding to it with interest rate surprises. For that reason, the middle market should be able to absorb future increases without undue stress.

Anticipating a slow rise in interest rates, Fifth Street has continued to position itself to take advantage of an up rate environment, seeking to blend down the level of LIBOR floors in its deal structures. Generally speaking, lenders don’t generate additional income and benefit from a rising interest rate environment until LIBOR surpasses the LIBOR floor, which had typically been structured at 100 basis points in recent years. By beginning to complete new deals with lower or no LIBOR floors, lenders are beginning to focus more on capturing spread and benefitting earlier from the rise in rates.

Recently, Fifth Street led its first deal in some time with no LIBOR floor and in the coming months, we expect to see LIBOR floors under pressure.

Where Will Middle Market

Lending Go in 2016?

Regardless of the pace of future rate hikes, we believe that the cost of capital is unlikely to go down. However, if the economy remains stable and we do not see a drastic increase in supply, we would expect purchase price multiples to stabilize over the next several quarters.

While no one can predict where credit quality will go, we are anticipating patchy growth and sector divergence. For instance, as we have noted for some time, we see ongoing strength in healthcare and technology. On the other hand, we continue to maintain that energy has further downside potential and has not yet reached its inflection point.

We believe it is prudent to avoid the cyclical industries while taking a more cautious approach to the higher valuation/higher leverage industries that generate high free cash flows. Conversely, we also counsel a shift toward safer, more recession-resistant sectors. Deals in the former category are still getting done; however, that universe seems to be waning today.

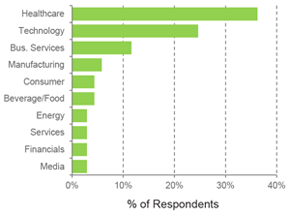

Sectors with Greatest

Growth Potential

Source: Thomson Reuters LPC’s

1Q16 MM Investor Outlook Survey.

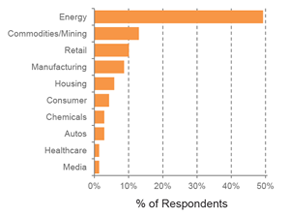

Sectors with the Greatest

Downside Potential

Source: Thomson Reuters LPC’s

1Q16 MM Investor Outlook Survey.

Fifth Street Activity

Middle Market Direct Lending continues to gain increased attention as an asset class, with many investors particularly attracted to the yield and relative protection that senior secured and unitranche loans can provide.

Due to Fifth Street’s 17-year track record of creating value through proprietary origination capabilities, discerning underwriting and portfolio management expertise, a variety of stakeholders have been looking to access our award-winning direct origination platform from a number of angles.

A Record $3 Billion in

Agented and Syndicated Loans in 2015

As we have continued to expand our capital markets presence over the last few years, the volume of our middle market syndications and club transactions has risen, which is partially attributable to increased interest from third parties to participate in our deals. These participations allow third parties, often lenders who do not have origination platforms of their own, to access loans that have not only been selected through our rigorous investment process, but are also supported by our established top-tier sponsor partnerships.

Fifth Street set a new company record last year, with over $3 billion of deals agented and syndicated in 22 deals across our platform(5). This represents a 67% increase over the $1.8 billion of deals agented and syndicated in 2014.

Separately Managed Account Closing

In further testament to the strength and value of the Fifth Street platform, earlier this month, we announced the closing of a Separately Managed Account (“SMA”) with a large, well-respected institutional investor who intends to purchase $50 million of middle market loans in the SMA.

Our platform’s ability to provide customized solutions across the capital structure to middle market companies and gain access to exclusive opportunities makes an SMA a compelling product for institutions seeking middle market asset exposure. Recent interest from institutional investors also led to Fifth Street’s closing of two collateralized loan obligations (CLOs) in 2015, as well as joint ventures with each of our business development companies (BDCs) in 2014.

We are looking forward to beginning our relationship with our new client and remain excited about the prospects of growing our institutional business line.

DISCLAIMER: Statements included herein about the middle market lending environment are based on observations made by Fifth Street deal professionals and were corroborated by Thomson Reuters LPC survey data and the Brown Gibbons Lang Annual State of the Middle Market (December 2015).

Some of the statements included herein constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, which relate to future events and/or Fifth Street Asset Management Inc.’s (“Fifth Street”) future performance or financial condition. Words such as “believes,” “expects,” “seeks,” “plans,” “should,” “estimates,” “project,” and “intend” indicate forward-looking statements. These statements are based on certain assumptions about future events or conditions and involve a number of risks and uncertainties. These statements are not guarantees of future performance, condition or results. Actual results may differ materially from those in the forward-looking statements as a result of a number of factors, including those described from time to time in our filings with the SEC.

The information contained in this article is summary information that is intended to be considered in the context of Fifth Street’s SEC filings and other public announcements that Fifth Street may make, by press release or otherwise, from time to time. Fifth Street undertakes no duty or obligation to publicly update or revise the forward-looking statements or other information contained in this article, except as required by law. These materials contain information about Fifth Street, its affiliated funds (including Fifth Street Finance Corp. and Fifth Street Senior Floating Rate Corp.) and general information about the market. You should not view information related to the past performance of Fifth Street and its affiliated funds or information about the market as indicative of future results, the achievement of which cannot be assured.

Nothing in these materials should be construed as a recommendation to invest in any securities that may be issued by Fifth Street or its affiliates or as legal, accounting or tax advice. None of Fifth Street, its affiliated funds or any affiliate of Fifth Street or its affiliated funds makes any representation or warranty, express or implied, as to the accuracy or completeness of the information contained herein and nothing contained herein shall be relied upon as a promise or representation whether as to the past or future performance. Certain information set forth herein includes estimates, projections and targets and involves significant elements of subjective judgment and analysis. No representations are made as to the accuracy of such estimates, projections or targets or that all assumptions relating to such estimates, projections or targets have been considered or stated or that such estimates, projections or targets will be realized.

This article is not intended to be an offer to sell, or the solicitation of an offer to purchase, any security (including Fifth Street Asset Management or its affiliates, Fifth Street Finance Corp. or Fifth Street Senior Floating Rate Corp.), the offer and/or sale of which can only be made by definitive offering documentation. Any other solicitation with respect to any securities that may be issued by Fifth Street or its affiliates will be made only by means of definitive offering memoranda or prospectus (as applicable), which will be provided to prospective investors and will contain material information that is not set forth herein, including risk factors relating to any such investment.

AccentCare

$135.0 Million

SEPTEMBER 2015

Healthcare Services

AccentCare is a Dallas, TX-based provider of post-acute healthcare services, ranging from personal, non-medical care to skilled home nursing, rehabilitation, hospice and attendant care services.

iPipeline

Undisclosed

AUGUST 2015

Internet Software & Services

iPipeline is an Exton, PA-based provider of cloud-based software solutions for the life insurance industry. Through its SaaS solutions, it accelerates and simplifies insurance sales, compliance, operations and support.

Too Faced Cosmetics, LLC

$150.0 Million

JULY 2015

Personal Products

Too Faced Cosmetics, LLC is an Irvine, CA-based prestige color cosmetics company providing a diversified range of eye, face and lip products through in-store and online channels, both domestically and internationally.

Garretson Resolution Group

$102.0 Million

MAY 2015

Diversified Support Services

Garretson Resolution Group is a Cincinnati, OH-based provider of outsourced medical lien resolution and complex settlement administration services to lawyers representing both plaintiffs and defendants in personal injury settlements.

Eos Fitness

Undisclosed

DECEMBER 2014

Leisure Facilities

Eos Fitness is a Phoenix, AZ-based 'High-Value Low-Price' fitness club chain operating locations across the Southwestern U.S.

Senior Associate

$ Million

JANUARY 1970

Uncategorized

Fifth Street Asset Management (“Fifth Street” or the “Firm”), headquartered in Greenwich, CT, is seeking a Senior Associate to work closely with the Firm’s Head of Institutional Business Development and Collateralized Loan Obligations on institutional capital raising and important strategic initiatives.

Responsibilities will include, but will not be limited to:

- Developing a thorough understanding of Fifth Street and its broad-based capabilities as well as the motivations and preferences of different types of institutional investors (i.e., pension funds & their consultants, endowments, insurance companies, family offices, etc.).

- Supporting institutional marketing activities:

- Ensuring all firm marketing materials are consistently up to date and optimized;

- Preparation of due diligence questionnaires (“DDQs”) and drafting responses to formal requests for proposals (“RFPs”);

- Maintaining up-to-date investor details in the Firm’s various data bases; and

- Modeling contemplated structures.

- Planning and coordinating road shows (deal and non-deal specific).

- Attending select investor meetings and conferences with senior management, taking appropriate notes and “owning” the requisite follow up (ensuring that such is done on a timely basis consistent with the Firm’s high standards).

- Performing various ad hoc analysis and tasks as necessary.

Fifth Street Finance Corp. and Fifth Street Senior Floating Rate Corp. Release November 2015 BDC Newsletter

$ Million

JANUARY 1970

our-newsletter

Middle Market Origination Report: Positioned for a Strong Finish to 2015

Middle market loan volume is down roughly 30% in the first three quarters of 2015 when compared to 2014 (1). We believe that reduced volumes are the result of a slowdown in LBO activity driven by higher purchase price multiples and recent market volatility. However, the year has followed a normal seasonal pattern and our pipeline has been building into year end, setting the stage for the December quarter. Notwithstanding the overall reduction in volumes, lenders with direct origination franchises, such as Fifth Street, have demonstrated the ability to uncover pockets of opportunity even in challenging market environments. During the first half of 2015, FSC and FSFR had gross originations of $821.3 million, which is in line with the first half of last year where FSC and FSFR had $820.0 million of gross originations.

SEC Proposes Liquidity Management Rules for Mutual Funds and ETFs

On September 22nd the SEC proposed legislation that requires open-end mutual funds and exchange-traded funds to better manage their liquidity. The legislation would obligate these funds to classify the liquidity of each portfolio asset and place a 15% limit on assets deemed to be illiquid. We believe that the implementation of these rules could present an opportunity for FSC and FSFR given that the new guidelines could reduce mutual fund and ETF demand for middle market broadly syndicated loans, as they may be less likely to purchase those assets. The proposed legislation is currently in the comment period and will need additional approval from the SEC Commissioners before it is implemented. While it is still in the early stages, we believe that the new liquidity management rules could positively impact the Fifth Street platform.

Technology Spotlight: Opportunities in Venture Debt

A recent trend in the technology investment space has been the proliferation of companies with valuations exceeding $1 billion – or “unicorns.” In order to achieve such lofty valuations, companies are issuing equity securities that not only behave like debt through their liquidation preferences, but also guarantee investors a multiple on investment, thus forcing these companies to pursue growth at all cost. In contrast, venture debt is far less dilutive and allows the company to adjust its operating strategy based on prevailing market conditions as the growth bar is much lower. As a result, we are cautiously optimistic that there will be more opportunities for our venture lending team to prudently invest in healthy, growing companies that will generate strong risk-adjusted returns. We focus on companies that have sustainable business models with non-cyclical demand drivers, as exhibited by investments FSC recently closed in Swipely, a payments and analytics company, and Quorum, a disaster recovery firm.

Executive Focus: Comments from FSC’s CEO and FSFR’s President, Todd Owens

Why do you think the BDC industry is trading below book value and how can the disparity be improved?

Over the last 18 months, the BDC industry has been negatively impacted by a number of events: the exclusion of BDCs from stock indexes, which reduced institutional investor interest; the plunge in oil prices and its impact on energy-focused businesses; concern around the credit cycle and the steady decline in yields paradoxically coupled with increasing concerns that rates would soon rise. As a result, BDC stock prices have been under pressure and the industry is trading at levels that we haven’t seen since the credit crisis in 2009. I think investors are weary of credit generally and concerned specifically about the balance sheet exposures (particularly energy) in the BDC space. As the industry reports results that reduce these concerns, I hope that we will see renewed investor interest in the sector.

What are some trends you are seeing in the BDC industry?

Volumes are lower this year than last, though still following the typical seasonal pattern. As a result, we expect that we will see seasonally higher origination volumes as we head into year end. Pricing and terms have been reasonably static over the course of this year, though there is some hope that the volatility we have seen in the broader markets will translate into marginally better pricing in the middle market. On the credit side, we are seeing a reversion to mean, with a more typical level of credit issues in the industry and in our portfolio, which is a change from the largely benign credit environment over the last several years.

What opportunities are there for FSC and FSFR?

The investment tailwinds for the BDC industry continue. Regulatory pressure on banks is real and, if anything, increasing, which impairs the ability of banks to compete for middle market assets. More recently, the SEC liquidity proposals are likely to reduce the appetite of mutual funds and ETFs for these less liquid assets. As a result, I expect BDCs and other non-bank capital sources to continue taking market share. Having said that, as we head into an environment with increasing credit risk and market volatility, we need to be thoughtful about putting capital to work into high-quality assets with strong risk-adjusted returns. While we have the opportunity to grow our market shares, the risks around credit have increased as well.

FSC Completes Share Repurchases

During August and September, FSC executed on its previously announced plan to repurchase shares in the open market, completing an approximately $20 million buyback. Management and the Board of Directors will continue to evaluate repurchasing shares on the open market, as we seek ways to continue providing strong risk-adjusted returns to our shareholders and stabilize our net asset value per share.

Addressing the Recent Class Action Lawsuits

On October 22nd, we filed a Form 8-K that addresses two class action lawsuits filed against FSC. FSC believes that the claims are without merit and intends to vigorously defend itself against the plaintiffs’ allegations.

* * *

We look forward to discussing our fiscal year results during FSC’s and FSFR’s respective earnings calls. FSC’s conference call is scheduled for December 1, 2015, and FSFR’s is scheduled for December 8, 2015. Information related to the earnings calls can be found on our Investor Relations website.

Sincerely,

The Fifth Street Team

(1) Thomson Reuters LPC’s 4Q15 MM Investor Outlook Survey, 10/2/15. Middle market is defined as companies with EBITDA of $50MM or less.

About Fifth Street Finance Corp.

Fifth Street Finance Corp. is a leading specialty finance company that provides custom-tailored financing solutions to small and mid-sized companies, primarily in connection with investments by private equity sponsors. The company originates and invests in one-stop financings, first lien, second lien, mezzanine debt and equity co-investments. FSC's investment objective is to maximize its portfolio's total return by generating current income from its debt investments and capital appreciation from its equity investments. The company has elected to be regulated as a business development company and is externally managed by a subsidiary of Fifth Street Asset Management Inc. (NASDAQ:FSAM), a nationally recognized credit-focused asset manager with over $5 billion in assets under management across multiple public and private vehicles. With a track record of over 17 years, Fifth Street's platform has the ability to hold loans up to $250 million and structure and syndicate transactions up to $500 million. Fifth Street received the 2015 ACG New York Champion's Award for "Lender Firm of the Year," and other previously received accolades include the ACG New York Champion's Award for "Senior Lender Firm of the Year," "Lender Firm of the Year" by The M&A Advisor and "Lender of the Year" by Mergers & Acquisitions. FSC's website can be found at fsc.fifthstreetfinance.com.

About Fifth Street Senior Floating Rate Corp.

Fifth Street Senior Floating Rate Corp. is a specialty finance company that provides financing solutions in the form of floating rate senior secured loans to mid-sized companies, primarily in connection with investments by private equity sponsors. FSFR's investment objective is to maximize its portfolio's total return by generating current income from its debt investments while seeking to preserve its capital. The company has elected to be regulated as a business development company and is externally managed by a subsidiary of Fifth Street Asset Management Inc. (NASDAQ:FSAM), a nationally recognized credit-focused asset manager with over $5 billion in assets under management across multiple public and private vehicles. With a track record of over 17 years, Fifth Street's platform has the ability to hold loans up to $250 million and structure and syndicate transactions up to $500 million. Fifth Street received the 2015 ACG New York Champion's Award for "Lender Firm of the Year," and other previously received accolades include the ACG New York Champion's Award for "Senior Lender Firm of the Year," "Lender Firm of the Year" by The M&A Advisor and "Lender of the Year" by Mergers & Acquisitions. FSFR's website can be found at fsfr.fifthstreetfinance.com.

Forward-Looking Statements

This press release may contain certain forward-looking statements, including statements with regard to the future performance of FSC and/or FSFR. Words such as “believes,” “expects,” “estimates,” “projects,” “anticipates,” and “future” or similar expressions are intended to identify forward-looking statements. These forward-looking statements are subject to the inherent uncertainties in predicting future results and conditions. Certain factors could cause actual results to differ materially from those projected in these forward-looking statements, and these factors are identified from time to time in the companies’ respective filings with the Securities and Exchange Commission (as applicable). The companies do not undertake any obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

CONTACT:

Investor Contact:

Robyn Friedman, Senior Vice President, Head of Investor Relations

(203) 681-3720

ir@fifthstreetfinance.com

Media Contact:

Nick Rust

Prosek Partners

(212) 279-3115 ext. 252

pro-fifthstreet@prosek.com

Executive Assistant

$ Million

JANUARY 1970

Uncategorized

Fifth Street is seeking an Executive Assistant for its Greenwich, CT office. The ideal candidate must have prior experience working as an Administrative / Executive assistant. They must exhibit exceptional organizational skills, strong attention to detail and the ability to multi-task in a fast paced environment. Responsibilities will be complex and confidential requiring the utmost level of discretion and independent judgment. Employees in this role will have constant contact with high levels of internal and external management.

Responsibilities will include but are not limited to:

- Provide direct support to the CEO and Chief of Staff

- Provide backup support to others on the Administrative team

- Coordinate frequent and complex travel arrangements for the team including scheduling of Investor Relations road shows

- Prepare and review materials for meetings

- Oversee calendar management

- Answer incoming calls, file, fax, bind and send packages

- Manage expense reports

- Must be flexible to handle any needs that may arise

Fifth Street's Q3 2015 Capital Markets Outlook

$ Million

OCTOBER 2015

news-media

Banking on the Fourth Quarter

Despite disappointing middle market deal flow so far this year, lenders expect fourth quarter activity to be seasonally higher. With year-to-date volume trailing by roughly 30% versus the prior year, most middle market participants have experienced lackluster volumes in 2015(1). However, in our observation, select lenders (especially those with a direct origination platform) saw a pickup in activity heading into September.

Overall, the middle market still looks healthy as compared to the Broadly Syndicated Loan (“BSL”) space, which has succumbed to wider market volatility. Both middle market investor demand and appetite to finance new transactions show solid underpinnings. Additionally, pricing remains relatively stable, as compared to the BSL and high yield markets, owing to the middle market’s ongoing supply/demand imbalance. Looking ahead, lenders anticipate an uptick in activity, based on growing deal pipelines. Though they expect non-sponsored issuance to remain flat, lenders are counting on an increase in sponsored transactions (See Figure 1, right), which to date have only reached $35.7 billion this year (versus $51.9 billion during the corresponding period in 2014)(1).

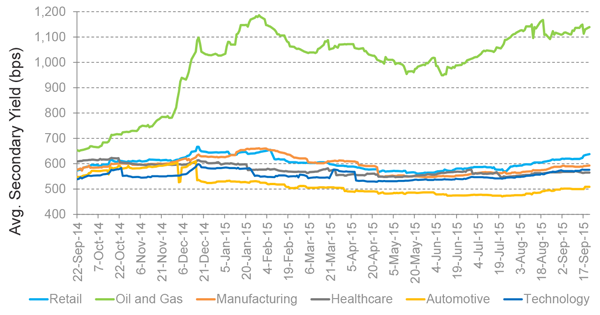

As Predicted, Energy Disappoints

Within leveraged lending, sector performance diverged widely this quarter. The broad S&P Leveraged Loan Index was essentially flat, while the oil and gas sector retreated materially. Following HY, cracks have surfaced in the BSL space and, to a lesser extent, in the middle market. As we have maintained for some time, defaults in the energy sector will likely materialize as companies confront a refinancing wall. In our opinion, this realization has contributed to the sector’s most recent rise in yields, reaching 1,139 bps towards the end of September, as opposed to 653 bps at the same time last year (See Figure 2). Higher yields may appear tempting—and at some point, opportunities will emerge—however, in our view, we have yet to reach the inflection point.

Overall Secondary Yield by Sector

Source: Thomson Reuters LPC Middle Market Weekly; As of 9/25/15.

BSL: A Harbinger of Things to Come?

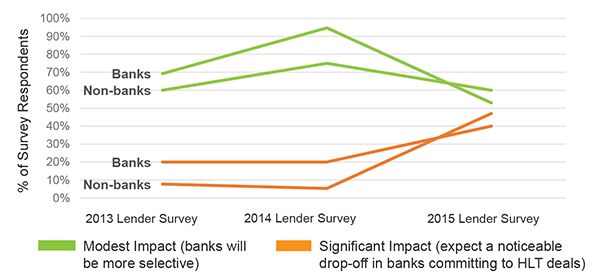

Sector rotation and a flight to quality continue to characterize the BSL space and echoes of these trends can be seen in the middle market as well. For instance, many lenders remain partial to first lien positions, seeking the relative safety provided by participating higher in the capital structure.